The ESG Data Deluge: Navigating the Turbulent Waters of Sustainable Investing

Investors grapple with a growing tide of inconsistent and incomplete ESG data, hindering progress toward sustainable goals.

The demand for environmental, social, and governance (ESG) investing has surged in recent years, driven by a growing awareness of climate change, social inequality, and the need for responsible corporate behavior. Yet, the very foundation of this movement – reliable and consistent ESG data – remains a significant hurdle for investors worldwide, according to a new report by BNP Paribas.

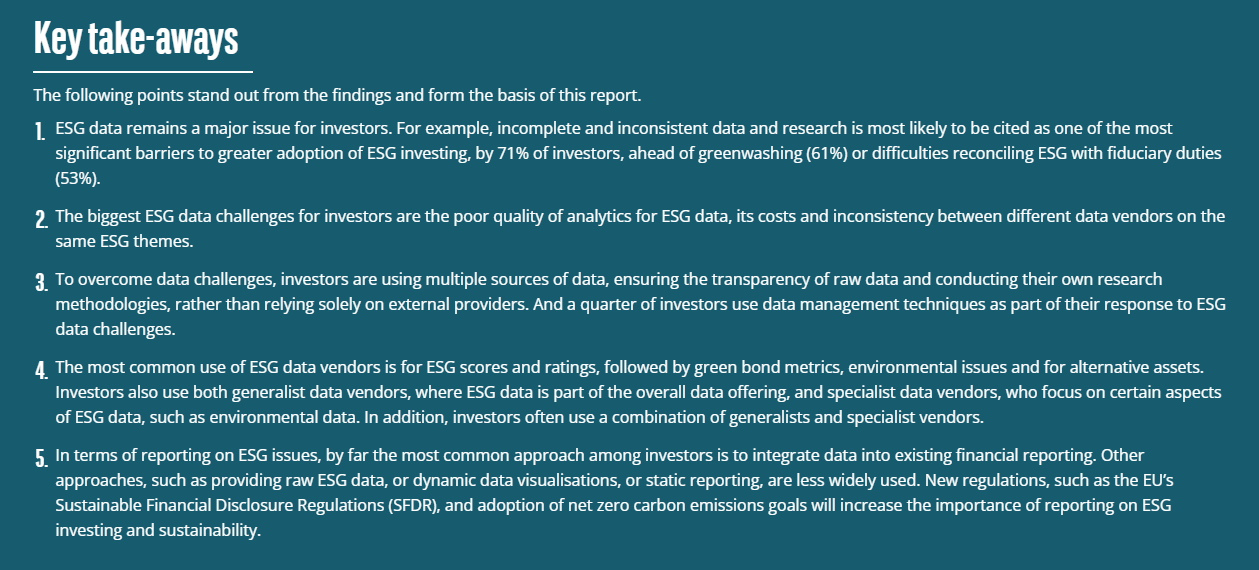

The survey of 420 institutional investors globally paints a stark picture: 71% cite incomplete and inconsistent data as the biggest barrier to wider ESG adoption, surpassing concerns like greenwashing (61%) and fiduciary duty conflicts (53%). This echoes previous findings, highlighting the persistent nature of the data challenge despite the expansion of the ESG investing landscape.

The Data Dilemma: A Global Headache

The report identifies three key pain points: the poor quality of ESG data analytics (46%), the cost of acquiring this data (40%), and inconsistencies between different data vendors (40%). These challenges are amplified by a lack of transparency in non-financial data, difficulties in aggregating data at the portfolio level, and data that is often too backward-looking to be truly useful.

The specific challenges resonate differently across geographies and investor types. European investors, for example, are more concerned about the cost of ESG data, likely due to their greater reliance on multiple vendors. Asset managers, more exposed to regulatory scrutiny and greenwashing accusations, also express stronger concerns about data costs. Meanwhile, hedge funds and private equity firms prioritize data transparency, perhaps reflecting the opaque nature of their investments.

Data Deserts: The Developing World’s Double Burden

While the developed world grapples with data inconsistencies and costs, emerging markets like Kenya and the broader African continent face a more fundamental challenge: a scarcity of ESG data itself. Many companies in these regions lack the resources or expertise to collect and report ESG data, creating significant blind spots for investors. This data deficit is compounded by underdeveloped regulatory frameworks and a lack of standardized reporting practices.

Consider the context: while the report highlights the difficulties investors face in obtaining reliable Scope 3 emissions data (emissions from a company's value chain), many companies in developing economies struggle to even report Scope 1 and 2 emissions (direct and indirect emissions from operations). The gap in data availability becomes even wider when considering complex ESG factors like biodiversity or social impact, where standardized metrics and reporting frameworks are still nascent even in developed markets.

This lack of data poses a double burden for developing economies. It limits their ability to attract responsible investment, hindering sustainable development efforts. It also obscures the true ESG performance of companies operating in these regions, potentially leading to unintended negative consequences, such as capital flight to companies with seemingly better ESG profiles in developed markets.

Bridging the Data Divide: A Collaborative Approach

The BNP Paribas report highlights several strategies investors are employing to navigate the data challenge: using multiple data sources, demanding greater transparency, and conducting in-house research. However, these approaches are often resource-intensive and may not be feasible for all investors, particularly those focused on emerging markets.

Addressing the ESG data challenge requires a multi-pronged approach involving collaboration between investors, companies, data providers, and regulators.

- Capacity Building: Supporting companies in developing economies to collect and report ESG data is crucial. This includes providing technical assistance, developing localized reporting frameworks, and promoting awareness of the benefits of ESG disclosure.

- Data Standardization: Harmonizing ESG reporting standards globally can enhance comparability and reduce inconsistencies. Initiatives like the International Sustainability Standards Board (ISSB) are a step in the right direction.

- Technology and Innovation: Leveraging technology, such as artificial intelligence and machine learning, can help fill data gaps and improve the efficiency of ESG data analysis. However, caution must be exercised to avoid biases and ensure transparency in the use of such technologies.

- Collaboration and Data Sharing: Encouraging data sharing and collaboration between investors, data providers, and companies can create a more complete and reliable ESG data ecosystem. Open-data initiatives and industry collaborations can play a vital role in this process.

- Regulatory Support: Clear and consistent regulations on ESG disclosure can incentivize companies to provide high-quality data. Regulators should also address greenwashing concerns and promote transparency in the ESG data market.

The Path Forward: From Data Chaos to Data Clarity

The ESG data challenge is a significant but not insurmountable obstacle. By fostering collaboration, promoting standardization, and investing in capacity building, we can move towards a future where ESG data empowers investors to make informed decisions, drive positive change, and achieve their sustainable investment goals. The journey from data chaos to data clarity is essential for unlocking the full potential of ESG investing and building a more sustainable future for all.